by James Harkin on Tuesday, April 29th, 2014

It has been just over a month since the last newsletter was sent

regarding the Global Currency Reset. Many subscribers have emailed

asking for updates. Although Pastor Williams has told me there is

nothing new from his elite friend I have looked at a few articles that

are talking in the mainstream about things that Pastor Williams has

warned about in the past. This newsletter may help you understand a

little more about what is about to happen to the U.S. economy and the

world in the next few years based on official statements from members of

the Elite as well as IMF, World Bank, U.N. and more. In this newsletter

I will discuss the Global Currency Reset, Gold, the One-Off Wealth Tax,

China, Climate Change and World Government. All these things should

make you understand in the next few years the entire global economy will

change and you should be making preparations right now to protect not

only your financial future, but the future of your health and wellbeing.

I have conversed via email with Pastor Williams regularly over the past month and he has told me that “the correction will be soon and horrifying to most people.” The important information Pastor Williams has provided us with in his DVDs ‘Elite Emergency Data’ and ‘Global Currency Reset’ is still valid. Pastor Williams had this to say regarding certain comments on his website that complained that the Global Currency Reset hasn’t already happened. Pastor Williams said “If people only knew, they would hope that the Elite and IMF delay the Global Currency Reset forever. It almost sounds if some people want judgement. In my DVD, I said “Possibly within Ninety Days.”

Sorry to disappoint those who are looking forward to a crash”. Please remember it was not Pastor Williams himself making the prediction this information came from his Elite friend. Pastor Williams shared this information knowing that a concrete timeframe can cause all kinds of problems if it fails to occur. He has risked his reputation on sharing information relating to the GCR and he did it because he was afraid for what would happen to the American people when this event occurs. This event will occur, the IMF do not share idle or speculative comments. Pastor Williams has told me “I still have no new news as my Elite friend is travelling for a few months and I hear from him very seldom. Tell those who want the Reset that my Elite friend knows when it will happen and will probably be home when it takes place so that he will not be in the unrest that will be a result. Relax for a while – Thank the Lord for this delay – Hard times will come soon enough.”

While the Elite, Christine Lagarde and the International Monetary Fund (IMF) did not achieve their desired ninety days (three months) timeframe their plans have not changed whatsoever. They are still going ahead and this is now public knowledge. Take every day that the reset doesn’t happen as a blessing and another day when you can continue to prepare. We are in this situation due to the people’s abdication of responsibility, lack of interest as well as wilful ignorance of anything outside their comfort zone. We have been so dumbed down and kept busy chasing the American dream that we have been asleep as our rights, our property, our freedom has been taken away from us. It is our responsibility to regain our power. We each have a responsibility to look after our family and not rely on the government, corporations and other third parties to do this for us. Pastor Williams has been telling us for years that we must take responsibility, some of us have taken his word and taken the steps to protect our families, others have waited. Eventually it will be too late and those will wish they had taken the helpful advice Pastor Williams has given. I say again do the following things, they are essential to protect your family, if you fail to carry out the steps you, your family and future generations will be reliant on the Elite from the day they are born until the day they die. Buy every piece of gold you can lay your hands on, Get out of debt, Get out of paper, Pay off your house mortgage, Store or buy food, water and personal protection, Get ready for the biggest buying opportunity of your lifetime, Get out of the city, Purchase everything you need, Sort out your medicine cabinet and Get your spiritual house in order. These 10 steps are specifically written to help you avoid, even prosper through the crash that is ever rapidly approaching. Do not think that because the stock market is booming that things are okay. Things are far from okay. This stock market boom is based on the Federal Reserve pumping cash into the system every month. It’s a fake boom, another bubble that will burst. Get your money into tangible assets as soon as you can.

http://www.youtube.com/watch?v=VgvLPCPoTKQ

In the question and answer session at the end of the event, Christine Lagarde said “It’s also true that if very well done a good balance sheet assessment of all banks and a good stress test would also participate in the building up of what would be needed for some mutualisation of debt.” Ultimately this is both commercial banks as well as central banks. In regards to tapering on emerging economies she said “On the spill over effects on emerging market economies of tapering. What we have seen in May has been much talked about the actual flow of capitals has not been that big. What we’ve also seen is that not all emerging markets have been affected in the same way and in that way markets and investors are very cunning, they look at the fundamentals of economies, they look at the strength of government, they look at the predictability of policies, they look at the policy mix and then they decide to move in, to stay or to move out. There are countries that have had hardly any currency movement and there are countries that have seen significant currency movement as a result of the talk of tapering and subsequently the announcement in December. But, clearly what has happened in between May and December has been very beneficial to some of the countries and India is a clear example of monetary policies as well as a reaffirmation of fiscal policies that have had an impact on how prepared the Indian economy is prepared.” As you can see Christine Lagarde is well aware of what happened when Ben Bernanke hinted at tapering that cause the stock market to drop and interbank lending rates increase.

In the same video Mark Carney, Governor of the Bank of England and a World Economic Forum Foundation Board Member at Davos 2014 also added to what Christine Lagarde had said about the ‘Reset’. With regards to risks he said “we have been in a very low volatility environment, in large part because of the policies of the major central banks. There are two dynamics one is to move back to a more normal volatility environment, which will feel like a big increase in volatility and potentially move further than that because of some of the structural changes in the financial system.” Mark Carney also talked about interest rate increases being reintroduced gradually. He wouldn’t put a date on it, but from what he said it is clearly looming within the short term.

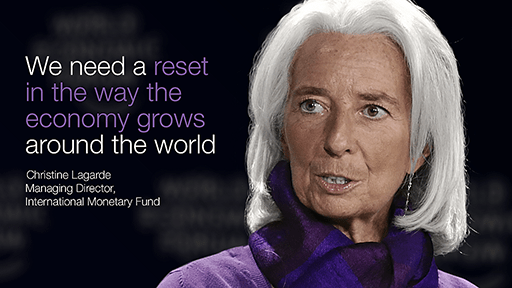

The day after the above remarks were made at Davos 2014, Christine

Lagarde was interviewed for Bloomberg. Her interview is entitled ‘An

Insight, an Idea with Christine Lagarde’. She announces her statement “What is needed is a ‘Reset’ of the way in which the economy grows around the world.”

She talks of old and new risks especially with China, India, Spain and

Iran. Old risks including: financial stability and bubbles; massive

unemployment worldwide, north of 200 million people; slow growth rate;

and an unbalanced and uneven growth rate. The new risks include:

Tapering and spill over effect; deflation particularly in Europe. With

regards to ‘Reset’ she talks about multiple fronts including: financial

sector regulatory environment being finalised and constantly

re-examined; reset of monetary policies by central banks of the advanced

economies since they have been using unconventional financial tools;

structural reforms in both advanced and emerging territories being below

potential. She mentions “rebalancing all over”. Christine Lagarde also

talks about inequalities widening globally over the last decade allowing

for less sustainable growth and mentions the potential for taxation to

change to a more Nordic Dual Income Tax system. The dual income tax

system according to Wikipedia levies a proportional tax rate on all net

income (capital, wage and pension income less deductions) combined with

progressive tax rates on gross labour and pension income. This implies

that labour income is taxed at higher rates than capital income, and

that the value of the tax allowances is independent of the income level.

Have a look further down the page for information relating to a new tax

that the Elite wish to implement in order to fund their One World

Government.

Later in the interview Christine Lagarde talks about political risks in Arab countries and focuses on Iran where the IMF, have started implementing ‘Article 4’. If you would like more information regarding what the IMF are doing with Iran you can see updated information here:

http://www.imf.org/external/country/IRN/index.htm

Christine Lagarde confirmed that there is no longer any risk of collapse of the E.U., which is very interesting since it has been said by other Elite that the U.S. economy would collapse after the E.U. We will see. In the interview she focused on women not just in economic factors, but in changes in day care, education as well as cultural changes. This is very interesting to me, because the Elite are against the nuclear family. The Elite see the nuclear family as a threat to complete control of humanity. It would be beneficial to the Elite to have both parents working while children are raised and indoctrinated by state institutions. At the end of the interview Christine Lagarde talks about Climate Change being a key challenge for the IMF and major events in 2014 and in 2015 will see significant events to push towards dealing with climate change. Of course since this is the IMF, it is more to do with finance than saving humanity from carbon and at the end of this newsletter you will see exactly why the Elite are pushing the climate change agenda as well as how long they have been focused on it. If you would like to listen to this interview you can here:

http://www.bloomberg.com/video/an-insight-an-idea-with-christine-lagarde-heKSl1aiRam4JbkkuGEGeg.html

“The global financial system, that has produced more and more credit in increasingly easier ways, possibly has reached the point that it can no longer operate in an official way.”

– Bill Gross, founder of investment company PIMCO (2012)

A day or so ago I received an article from Investing.com with an interview with Terence van der Hout of the Netherlands-based Commodity Discovery Fund regarding “Preparing for a Reset of the World’s Reserve Currency”. In the article it mentions that the U.S. and the IMF are already planning to replace the U.S. Dollar. It also talks about SDR’s (Standard Drawing Rights). The article also talks about the resets following the crisis in Germany after the Weimar hyperinflation in 1923, and more recently, in Cyprus. Also it talks about George Soros saying in an interview with The Financial Times that the system is broken and needs to be reconstituted as well as talking about Christine Lagarde’s ‘Reset’.

With regards to gold Terence van der Hout said that we have seen lots of manipulation of the gold price, similar to the 1960’s when the London Gold Pool was keeping prices at $35 an ounce. He said that there has been another round of manipulation in the last few years and that it cannot go on in the short to medium term. He says a revaluation toward $4,200 an ounce or gold prices will have to rise because of structural deficits in the gold market. Global gold production cannot keep up with the growing demand for physical gold and says the World Gold Council shows a deficit of 700 tons of physical gold.

He talks about China and Russia growing their physical gold reserves enormously. Other information within the article talks about gold mining and gold funds as well as silver being the poor man’s gold. He says when the gold price goes up too much, more people start to buy silver. He also says there are no large above the ground stockpiles available anymore.

It is an interesting interview you can read the full article here:

http://www.investing.com/analysis/preparing-for-a-reset-of-the-world’s-reserve-currency-210197

I have conversed via email with Pastor Williams regularly over the past month and he has told me that “the correction will be soon and horrifying to most people.” The important information Pastor Williams has provided us with in his DVDs ‘Elite Emergency Data’ and ‘Global Currency Reset’ is still valid. Pastor Williams had this to say regarding certain comments on his website that complained that the Global Currency Reset hasn’t already happened. Pastor Williams said “If people only knew, they would hope that the Elite and IMF delay the Global Currency Reset forever. It almost sounds if some people want judgement. In my DVD, I said “Possibly within Ninety Days.”

Sorry to disappoint those who are looking forward to a crash”. Please remember it was not Pastor Williams himself making the prediction this information came from his Elite friend. Pastor Williams shared this information knowing that a concrete timeframe can cause all kinds of problems if it fails to occur. He has risked his reputation on sharing information relating to the GCR and he did it because he was afraid for what would happen to the American people when this event occurs. This event will occur, the IMF do not share idle or speculative comments. Pastor Williams has told me “I still have no new news as my Elite friend is travelling for a few months and I hear from him very seldom. Tell those who want the Reset that my Elite friend knows when it will happen and will probably be home when it takes place so that he will not be in the unrest that will be a result. Relax for a while – Thank the Lord for this delay – Hard times will come soon enough.”

While the Elite, Christine Lagarde and the International Monetary Fund (IMF) did not achieve their desired ninety days (three months) timeframe their plans have not changed whatsoever. They are still going ahead and this is now public knowledge. Take every day that the reset doesn’t happen as a blessing and another day when you can continue to prepare. We are in this situation due to the people’s abdication of responsibility, lack of interest as well as wilful ignorance of anything outside their comfort zone. We have been so dumbed down and kept busy chasing the American dream that we have been asleep as our rights, our property, our freedom has been taken away from us. It is our responsibility to regain our power. We each have a responsibility to look after our family and not rely on the government, corporations and other third parties to do this for us. Pastor Williams has been telling us for years that we must take responsibility, some of us have taken his word and taken the steps to protect our families, others have waited. Eventually it will be too late and those will wish they had taken the helpful advice Pastor Williams has given. I say again do the following things, they are essential to protect your family, if you fail to carry out the steps you, your family and future generations will be reliant on the Elite from the day they are born until the day they die. Buy every piece of gold you can lay your hands on, Get out of debt, Get out of paper, Pay off your house mortgage, Store or buy food, water and personal protection, Get ready for the biggest buying opportunity of your lifetime, Get out of the city, Purchase everything you need, Sort out your medicine cabinet and Get your spiritual house in order. These 10 steps are specifically written to help you avoid, even prosper through the crash that is ever rapidly approaching. Do not think that because the stock market is booming that things are okay. Things are far from okay. This stock market boom is based on the Federal Reserve pumping cash into the system every month. It’s a fake boom, another bubble that will burst. Get your money into tangible assets as soon as you can.

Global Currency Reset

It is now public knowledge that the IMF, are planning a global currency reset. This reset will be the largest financial event in over 1,000 years. In January 2014 The World Economic Forum at Davos was held. At the event Christine Lagarde, managing director of the IMF was there to talk about two R’s, ‘Risks’ regarding tapering and deflation as well as ‘Reset’. As with all Elite, they are always vague and never talk in specifics, unfortunately you have to read between the lines. Christine Lagarde said this about reset “my last ‘R’ is ‘Reset’ we see as necessary going forward a reset in the area of monetary policies, we believe that quantitative easing and the accommodating monetary policies that have been adopted so far should be continued up until such point where growth is well anchored in those economies and this is not yet the case everywhere. Reset in the sense that once it is well anchored, then those accommodating monetary policies have to be reformulated, have to move either back into their old territories or be more traditional or be of a different kind. Second ‘Reset’ is the financial sector reform and regulatory environment that is clearly undergoing a major reset at the moment. The final ‘Reset’ is those structural reforms that are necessary in all corners of the world. Very often people think structural reforms for some of those advanced economies that have such rigid labour markets, no, it’s not just that and I am not sure I would not necessarily associate advanced economies with rigid markets nor would I mark flexibility as the ideal solution for it. But, structural reforms are needed in product markets, service markets, but they are also needed in emerging market economies where structural reforms can take a completely different form from those I have just mentioned. They have to do with bottlenecks in certain countries. They have to do with proper governance, and they certainly take multiple forms including that of unleashing the potential that is there, but that is still constricted by a lot of licensing rights, protective barriers and so forth.” I have left the statement virtually in its entirety for you to review. Here is the link to the video:http://www.youtube.com/watch?v=VgvLPCPoTKQ

In the question and answer session at the end of the event, Christine Lagarde said “It’s also true that if very well done a good balance sheet assessment of all banks and a good stress test would also participate in the building up of what would be needed for some mutualisation of debt.” Ultimately this is both commercial banks as well as central banks. In regards to tapering on emerging economies she said “On the spill over effects on emerging market economies of tapering. What we have seen in May has been much talked about the actual flow of capitals has not been that big. What we’ve also seen is that not all emerging markets have been affected in the same way and in that way markets and investors are very cunning, they look at the fundamentals of economies, they look at the strength of government, they look at the predictability of policies, they look at the policy mix and then they decide to move in, to stay or to move out. There are countries that have had hardly any currency movement and there are countries that have seen significant currency movement as a result of the talk of tapering and subsequently the announcement in December. But, clearly what has happened in between May and December has been very beneficial to some of the countries and India is a clear example of monetary policies as well as a reaffirmation of fiscal policies that have had an impact on how prepared the Indian economy is prepared.” As you can see Christine Lagarde is well aware of what happened when Ben Bernanke hinted at tapering that cause the stock market to drop and interbank lending rates increase.

In the same video Mark Carney, Governor of the Bank of England and a World Economic Forum Foundation Board Member at Davos 2014 also added to what Christine Lagarde had said about the ‘Reset’. With regards to risks he said “we have been in a very low volatility environment, in large part because of the policies of the major central banks. There are two dynamics one is to move back to a more normal volatility environment, which will feel like a big increase in volatility and potentially move further than that because of some of the structural changes in the financial system.” Mark Carney also talked about interest rate increases being reintroduced gradually. He wouldn’t put a date on it, but from what he said it is clearly looming within the short term.

Christine Lagarde, Chairman IMF at ‘Davos World Economic Forum’.

Later in the interview Christine Lagarde talks about political risks in Arab countries and focuses on Iran where the IMF, have started implementing ‘Article 4’. If you would like more information regarding what the IMF are doing with Iran you can see updated information here:

http://www.imf.org/external/country/IRN/index.htm

Christine Lagarde confirmed that there is no longer any risk of collapse of the E.U., which is very interesting since it has been said by other Elite that the U.S. economy would collapse after the E.U. We will see. In the interview she focused on women not just in economic factors, but in changes in day care, education as well as cultural changes. This is very interesting to me, because the Elite are against the nuclear family. The Elite see the nuclear family as a threat to complete control of humanity. It would be beneficial to the Elite to have both parents working while children are raised and indoctrinated by state institutions. At the end of the interview Christine Lagarde talks about Climate Change being a key challenge for the IMF and major events in 2014 and in 2015 will see significant events to push towards dealing with climate change. Of course since this is the IMF, it is more to do with finance than saving humanity from carbon and at the end of this newsletter you will see exactly why the Elite are pushing the climate change agenda as well as how long they have been focused on it. If you would like to listen to this interview you can here:

http://www.bloomberg.com/video/an-insight-an-idea-with-christine-lagarde-heKSl1aiRam4JbkkuGEGeg.html

“The global financial system, that has produced more and more credit in increasingly easier ways, possibly has reached the point that it can no longer operate in an official way.”

– Bill Gross, founder of investment company PIMCO (2012)

A day or so ago I received an article from Investing.com with an interview with Terence van der Hout of the Netherlands-based Commodity Discovery Fund regarding “Preparing for a Reset of the World’s Reserve Currency”. In the article it mentions that the U.S. and the IMF are already planning to replace the U.S. Dollar. It also talks about SDR’s (Standard Drawing Rights). The article also talks about the resets following the crisis in Germany after the Weimar hyperinflation in 1923, and more recently, in Cyprus. Also it talks about George Soros saying in an interview with The Financial Times that the system is broken and needs to be reconstituted as well as talking about Christine Lagarde’s ‘Reset’.

With regards to gold Terence van der Hout said that we have seen lots of manipulation of the gold price, similar to the 1960’s when the London Gold Pool was keeping prices at $35 an ounce. He said that there has been another round of manipulation in the last few years and that it cannot go on in the short to medium term. He says a revaluation toward $4,200 an ounce or gold prices will have to rise because of structural deficits in the gold market. Global gold production cannot keep up with the growing demand for physical gold and says the World Gold Council shows a deficit of 700 tons of physical gold.

He talks about China and Russia growing their physical gold reserves enormously. Other information within the article talks about gold mining and gold funds as well as silver being the poor man’s gold. He says when the gold price goes up too much, more people start to buy silver. He also says there are no large above the ground stockpiles available anymore.

It is an interesting interview you can read the full article here:

http://www.investing.com/analysis/preparing-for-a-reset-of-the-world’s-reserve-currency-210197

- See more at: http://www.lindseywilliams.net/pastor-lindsey-williams-global-currency-reset-update-april-29th-2014/#sthash.ureWlAP3.dpuf